Key Takeaways

- Learn how to design a token with clear purpose, sustainable tokenomics, and legal compliance to ensure long-term market stability.

- Discover launch strategies including ICO, IEO, and IDO, plus smart contract security, exchange listings, and liquidity planning.

- Build lasting adoption through community engagement, incentive programs, and continuous ecosystem expansion post‑launch.

Launching a token today is more than issuing a contract; it’s more about defining the value, building trust and creating a sustainable utility. With the crypto space scattered and crowded more than ever before, projects now must use thoughtful launch plans combining legal framework setup, community engagement and structured implementation.

Launching a governance token, a utility coin, or an asset-backed token requires a lot, such as aligning your vision, tokenomics, and growth strategies. In this guide, you’ll discover how to launch your token confidently and create a long-term effect beyond the initial offering stage by using practical strategies such as regulatory prep, legal structures, community-driving marketing, influencer collaboration, and adaptive feedback loops.

Build A Strong Foundation: From Purpose To Compliance

A successful token launch begins with a clear vision, legal foundation, and Strong tokenomics to ensure long‑term stability, compliance, and adoption.

Here’s what u must decide before writing a single code:

What problem does the token solve?

It is Important to know the purpose of your token. Other than just being tradable, knowing what purpose your token serves is essential, such as granting user access to your platform, securing and governing the network, rewarding active participation, or even serving as a digital asset with real value.

Which token model fits the project?

Deciding whether your token is for utility, governance, security, or hybrid changes how people will use it, view it, and even how your smart contracts are built. A clear choice upfront prevents legal headaches, guides your tokenomics, and ensures your project’s vision.

What is the economic incentive for holders?

Well-designed token incentives include staking rewards, governance participation, exclusive access, and long-term appreciation as the network expands. Without clear benefits for holders, enthusiasm fades and sustaining market momentum becomes challenging.

For a successful token launch, partnering with a professional token development company is essential. They provide the technical expertise, secure smart contracts, and strategic guidance needed to take your token from concept to market with confidence.

Craft Tokens That Withstand Market Pressure

Long-term token value is based on tokenomics. Even with a solid product, a poorly designed supply or distribution model can lead to a price collapse.

Key components include:

- Total Supply and Minting Policy

Deciding whether your token is a fixed supply or an inflationary model shapes your Token’s long-term value. Choosing between pre‑minting your tokens upfront or releasing them gradually to match network growth and real use cases is vital.

- Allocation and Vesting

Token allocation should balance trust and growth by distributing portions to the team and advisors, typically 15–25%, with 12–36‑month lockups to prevent early dumping. Public and community sales provide liquidity and decentralization, while the treasury fuels future development, partnerships, and reward programs.

- Utility and Incentives

Create real demand for your token by adding utilities like staking, token burns, governance voting, or activity-based rewards. Test different market scenarios to see how supply and demand will behave over time, ensuring the token remains stable and valuable in the long run.

Legal Strategy That Can Make or Break Your Token

Even the strongest token project can fail without proper compliance. Each jurisdiction has its own rules. Making legal preparations is a key step in any token launch. Here’s How:

Security vs. Utility Classification

Determining whether your token is a utility or a security is critical because securities require registration or exemptions under laws like the US Howey Test. A clear classification protects your project from regulatory risks and shapes how your token can be launched and traded.

KYC/AML Compliance

For ICOs, IDOs, and other fundraising events, meeting Know Your Customer (KYC) and Anti‑Money Laundering (AML) standards is mandatory in most regions. This step builds investor trust and shields the project from legal complications.

Jurisdictional Strategy

Launching in crypto‑friendly hubs such as Dubai, Singapore, or Switzerland gives your project a regulatory edge. Many teams also use SAFTs (Simple Agreements for Future Tokens) to raise funds from accredited investors before a public launch, staying compliant while securing early capital.

Pick A Perfect Launch Path That Fits Your Project Growth

A token’s market entry depends on the launch model you choose, which impacts fundraising, liquidity, and community trust.

Decide the best path for your project:

- Initial Coin Offering (ICO)

ICOs offer the highest fundraising potential and full community participation. However, they come with higher regulatory supervision and exposure to price changes. - Initial Exchange Offering (IEO)

IEOs offer immediate liquidity while letting the exchange handle a large portion of marketing and compliance. High listing costs and less direct community control are the trade-offs. - Initial DEX Offering (IDO)

IDOs are decentralized, fast, and cost‑efficient, and often work well with DeFi ecosystems. Success requires effective self-marketing and strategic liquidity planning. - Fair Launch & Community Mining

Fair launches build deep community trust and decentralization by avoiding pre‑sales. Yet, fundraising is slower and large holders can emerge if distribution isn’t monitored. - Hybrid Approaches

Many successful projects mix private sales, IEOs, and IDOs to create phased liquidity, spread risk, and maintain investor confidence throughout the launch cycle.

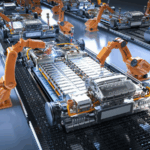

Writing Smart Contracts That Drive Security & Trust

Your token’s reliability starts with secure and well‑audited smart contracts to prevent costly breaches.

Build and protect the backbone of your token with this:

Audit‑Ready Code

Develop smart contracts using established standards to rely on trusted libraries, which helps in minimizing risks and follows proven security practices.

Multi‑Signature Treasury

Secure your token reserves and project funds by requiring multiple signatures for critical transactions, eliminating single‑point vulnerabilities.

Testnet Deployments & Simulations

Before going live, conduct comprehensive testnet deployments, load testing, and fuzzing simulations to find edge-case risks.

External Audits & Bug Bounties

To drive investor trust, confidence and Protection against real-world attacks, engage with top‑tier auditors and run bug bounty programs to reinforce investor confidence and protect against real‑world exploits.

Get Your Token Tradable and Stable

Market confidence comes from stable liquidity and the right exchange listings to support smooth trading.

Plan a listing strategy that keeps your token active and trusted, like this:

DEX Liquidity Pools

Secure liquidity with solutions like Team Finance or Unicrypt to prevent rug-pulling and maintain community trust by creating liquidity pools with stablecoins like USDT or USDC, and

CEX Listings

Start with Tier-2 exchanges to create trading history and reliability. Once your token gains enough volume and community traction, it can be promoted to Tier-1 listings.

Market‑Making & Price

Work with professional market makers to maintain healthy bid/ask spreads and focus on organic growth rather than artificial pumps to sustain long‑term stability.

Build Loyalty With Early Marketing Moves

Even a technically perfect token needs strong community support to succeed in the long run.

Here’s how to build engagement and excitement before the launch:

- Social Presence

Establish strong channels on X (Twitter), Telegram, Discord, and LinkedIn to communicate directly with early supporters and investors. - Content & Education

Sharing lightpapers, AMAs, and explainer videos to educate the audience and demonstrate reliability helps in making the market understand your token’s purpose. - Incentive Programs

Run airdrops, staking rewards, ambassador campaigns, and exclusive early adopter perks to encourage participation and strengthen community loyalty.

Ongoing Management for Long-Term Token Leadership

A successful token launch is only the start of a journey. Long‑term growth depends on active management, honest reporting, and community‑driven governance. Here’s how:

- DAO Governance Transition

Gradually move decision‑making to a DAO model, empowering token holders to vote on proposals, treasury use, and ecosystem development. - Ongoing Liquidity & Staking

Maintain healthy liquidity and incentivise long‑term holding through staking pools, ensuring Total Value Locked (TVL) remains strong. - Transparency & Reporting

Issue quarterly updates, publish treasury and burn schedules, and provide clear reporting to build lasting investor confidence. - Ecosystem Growth

Expand your token’s use cases by integrating with DeFi platforms, NFT projects, or partner ecosystems to drive ongoing demand.

Real-World Token Launch Strategies That Delivered Results

Learning from proven projects helps identify the strategies that drive adoption and strengthen community trust. Here’s how leading tokens did it:

- Filecoin (FIL)

Focused heavily on technical audits and long‑term mining incentives, which encouraged network security and sustainable growth. - Aptos (APT)

Implemented staggered token releases and ecosystem grants, preventing early market saturation while fostering developer participation. - SushiSwap (SUSHI)

Adopted a community‑driven launch with liquidity mining campaigns, rapidly gaining traction and challenging established players. - Success Factors

Successful token launches combine solid tokenomics, airtight security measures, and genuine community alignment to achieve long‑term impact.

Final Thoughts

Launching a cryptocurrency in 2025 is no longer just about creating a digital asset and expecting it to gain visibility. Success comes from combining a clear token purpose with a well‑structured economic model, supported by secure smart contracts, proper legal planning, and a practical fundraising approach. Projects that ignore any of these pillars often face short-lived market interest, regardless of how innovative their idea might seem.

Planning is equally essential for life after the launch. Building genuine interest through strong community engagement, managing liquidity responsibly, and continuously evolving the ecosystem are what separate lasting projects from those that fade after the initial listing. Teams that approach token launches with both technical precision and strategic planning are far more likely to earn market confidence and create a project that can thrive well beyond the first wave of excitement.