Introduction to Day Trading

Day trading is a dynamic and fast-paced trading style that involves buying and selling financial instruments within the same trading day. The objective is to capitalize on small price movements, taking advantage of market volatility. Unlike traditional investing, where assets are held for long periods, day traders often execute multiple trades in a single day, seeking to profit from short-term price fluctuations.

To succeed in day trading, one must possess a deep understanding of market mechanics and employ effective strategies. This is where advanced tools and techniques come into play, particularly those offered by platforms like Bookmap.com. With its innovative order flow tools, traders can gain insights that are crucial for making informed decisions.

Understanding Order Flow

Order flow refers to the actual buy and sell orders that are placed in the market at any given time. It provides insights into market sentiment and can reveal potential price movements before they occur. By analyzing order flow, traders can gauge the strength of buyers versus sellers, allowing them to make more informed decisions.

Understanding order flow is essential for any day trader aiming to enhance their trading strategy. It helps identify key support and resistance levels, as well as potential reversals and breakouts in price action.

The Importance of Visualization in Trading

One of the biggest challenges in day trading is interpreting raw data effectively. Visualization tools are critical for translating complex information into actionable insights. Traders need clear representations of market data to identify trends and patterns quickly.

Visualization helps in several ways:

1. Clarity: It presents data in an easily digestible format.

2. Speed: Traders can make quicker decisions based on visual cues.

3. Insight: Visuals can uncover relationships within data that may not be apparent through traditional analysis.

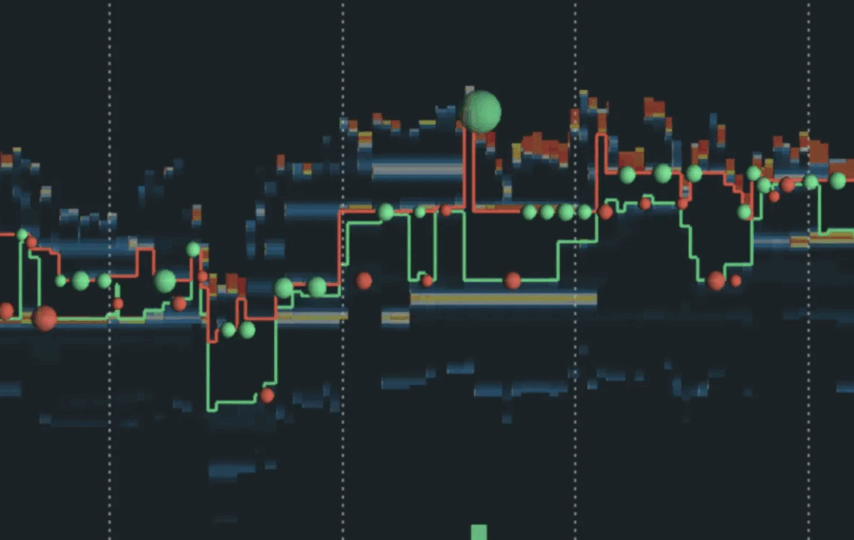

Bookmap.com excels in this aspect by providing an intuitive visual interface that displays real-time order flow data, allowing traders to see market movements as they happen.

Overview of Bookmap.com

Bookmap.com is an advanced trading platform designed specifically for visualizing order flow in real-time. It stands out from traditional charting platforms by offering a heatmap view that shows liquidity and order book dynamics at a glance.

The platform integrates seamlessly with various brokerage accounts and provides access to multiple financial instruments, including stocks, futures, and cryptocurrencies. Its unique features cater to both novice traders looking for guidance and experienced traders seeking deeper insights into market behavior.

Key Features of Bookmap’s Order Flow Tools

Understanding the key features of Bookmap’s order flow tools is vital for developing advanced day trading techniques:

1. Heatmap Visualization: This feature allows traders to visualize liquidity by displaying areas with high buy or sell interest.

2. Order Book Depth: Bookmap provides detailed insights into the order book depth, showcasing the number of buy/sell orders at various price levels.

3. Real-Time Data Feed: The platform offers real-time updates on trades executed, enabling traders to act swiftly.

4. Market Replay Functionality: Users can replay past market activity to analyze decision-making processes during previous trades.

5. Customizable Interface: Traders can tailor the layout according to their preferences, ensuring they have quick access to the information most relevant to their strategies.

These features empower traders with superior insights, which are crucial for executing advanced trading techniques effectively.

Advanced Techniques Utilizing Bookmap

With a robust understanding of order flow and familiarity with Bookmap’s features, traders can implement several advanced techniques:

1. Liquidity Hunting: This technique involves identifying areas with significant liquidity on the heatmap and placing trades that exploit these zones.

2. Momentum Trading: By monitoring real-time buy/sell orders, traders can enter positions aligned with prevailing trends, maximizing profit potential.

3. Scalping Strategies: Using tight stop losses and quick entries/exits based on order flow signals allows scalpers to capitalize on small price movements efficiently.

4. Swing Trading with Order Flow: Traders can analyze shifts in order flow over several hours or days to identify potential swing trade opportunities.

5. Combining Technical Analysis with Order Flow: Integrating traditional charting methods with order flow analysis enhances decision-making capabilities.

These techniques leverage real-time data provided by Bookmap.com, enabling traders to execute strategies that account for immediate market dynamics.

Real-Time Data Analysis and Decision Making

One of the standout advantages of using Bookmap’s order flow tools is the ability to conduct real-time data analysis effectively. Traders who utilize this functionality can observe live movements in the order book and adjust their strategies accordingly.

Taking immediate action based on real-time insights can significantly enhance a trader’s success rate:

1. Adaptive Strategies: Traders can modify their approaches based on current market conditions rather than relying solely on historical data.

2. Identifying Reversal Patterns: Monitoring sudden shifts in buy/sell pressure helps identify potential reversal points before they become apparent through traditional indicators.

3. Execution Speed: Quick decision-making facilitated by real-time data allows traders to enter or exit positions before price changes occur significantly.

By harnessing real-time data analysis through Bookmap.com’s tools, traders can stay ahead of market trends and respond proactively.

Risk Management Strategies

While pursuing gains through advanced day trading techniques is important, effective risk management cannot be overlooked. Day traders often face significant risks due to market volatility; thus, implementing sound risk management strategies is essential:

1. Setting Stop Losses: Always use stop-loss orders to protect against unexpected price movements.

2. Position Sizing: Determine position sizes based on account size and risk tolerance to prevent substantial losses.

3. Diversification: Avoid putting all capital into a single trade; diversifying across different instruments mitigates risk exposure.

4. Reviewing Performance: Regularly analyze past trades helps identify patterns that lead to successful outcomes or losses.

Leveraging risk management strategies alongside advanced techniques ensures a balanced approach towards day trading success.

Developing a Personalized Trading Strategy

Every trader has unique strengths and weaknesses; therefore, developing a personalized trading strategy tailored to individual preferences is crucial:

1. Assess Your Strengths: Identify which aspects of order flow analysis resonate most with your trading style.

2. Backtest Strategies: Utilize Bookmap’s replay functionality to test your strategies against historical data before deploying them live.

3. Continuous Learning: Stay updated on market trends and continuously refine your strategy based on emerging data analytics from platforms like Bookmap.com.

4. Seek Feedback: Engage with other traders or communities for feedback on your strategies; this collaborative learning can enhance your approach significantly.

Creating a personalized trading strategy allows traders to operate within their comfort zones while leveraging advanced tools effectively.

Elevating Your Trading Game

Incorporating advanced day trading techniques using Bookmap.com’s innovative order flow tools is essential for any trader serious about success in today’s fast-paced markets. By understanding order flow dynamics, utilizing visualization methods effectively, and applying robust risk management strategies, you will enhance your ability to navigate complex market conditions confidently.

As you continue exploring advanced techniques within this framework, remember that adaptability is key—markets evolve rapidly, and so should your strategies. Embrace continuous learning and experimentation with new approaches while leveraging the power of Bookmap.com’s capabilities to elevate your trading game further than ever before.

By committing yourself not only to mastering these techniques but also engaging actively with the community around you, you position yourself for long-term success in the exciting world of day trading.