Homeowners insurance is critical for protecting your investment, but that protection often comes at a high price. As premiums continually rise, particularly in risk-prone areas, it’s more important than ever for homeowners to find creative strategies for affordable coverage. While many turn to providers like the California FAIR Plan for last-resort options, there are proactive steps every homeowner can take to lower insurance costs without sacrificing peace of mind.

Reducing premiums isn’t about cutting corners or leaving your property vulnerable. Instead, it’s about leveraging improvements, smart policy management, and insurance discounts that many policyholders overlook. Even in challenging insurance markets, making thoughtful upgrades and regularly reviewing your policy can yield tangible savings—as well as leave you better protected from surprise expenses or disasters.

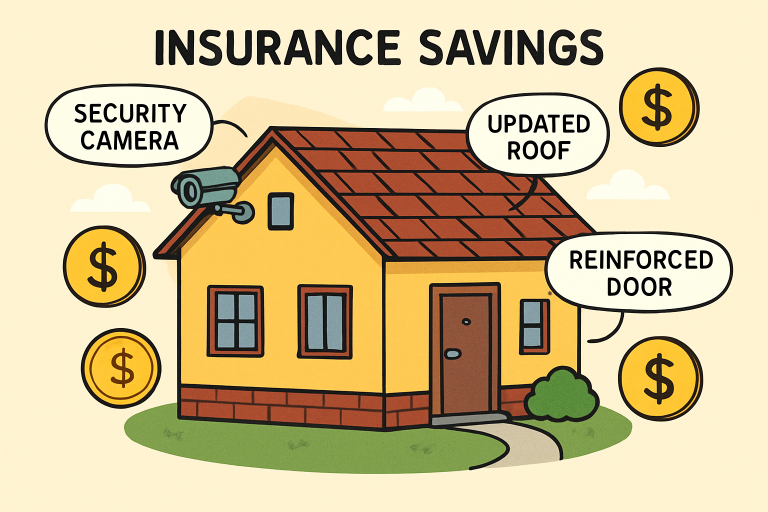

Enhance Home Security

Insurance providers reward proactive homeowners, particularly those who invest in home security upgrades. Installing a monitored home security system—such as Ring, ADT, or SimpliSafe—serves as a deterrent against potential intruders and can also trigger notable insurance discounts. Adding features like motion detectors, smart locks, and surveillance cameras improves your chance of qualifying for lower premiums. In addition, reinforcing doors with deadbolts and window locks enhances your home’s resilience and may be required by insurers for optimal policy rates. According to Kiplinger, simple DIY upgrades can significantly trim premium costs while boosting peace of mind.

Bundle Policies

Bundling insurance policies is an underrated but practical way to slash costs. By purchasing your home and auto policies from the same provider, you can save up to 30% on premiums through multi-policy discounts. Besides cost savings, bundling streamlines your insurance management—fewer bills, simpler claims processing, and a clearer relationship with your insurer. Industry experts note that even renters’ and umbrella policies can often be combined for extra savings and unified protection. For more details, see this guide on creative ways to lower your home insurance bill.

Increase Deductibles

Raising your deductible—the amount you’re responsible for before insurance kicks in—directly reduces your annual premium. If you increase your deductible from $500 to $1,000, the Insurance Information Institute notes that you could cut your annual premium by 15% to 20%. However, ensure your emergency savings can comfortably absorb the deductible if disaster strikes. Balancing a higher deductible with a strong savings cushion allows you to enjoy lower fixed expenses while still being prepared for unexpected damage or loss.

Invest in Home Improvements

Upgrading your home not only enhances comfort and value, but it can also significantly influence your insurance rates. Installing impact-resistant roofing, storm shutters, or retrofitting your structure for earthquake or hurricane resistance shows your insurer that your home is less likely to suffer catastrophic loss. Studies in hurricane-prone regions demonstrate that homes upgraded to fortified standards are less likely to incur major insurance claims after storms, leading to reduced premiums and better long-term protection. For instance, after Hurricane Sally, fortified homes in Alabama saw much fewer severe claims—validating the investment in disaster-resistant improvements. Read more about disaster-proof upgrades in this Associated Press report.

Maintain a Claims-Free Record

A history of infrequent claims can be one of the most powerful factors in keeping home insurance rates low. Providers typically offer discounts to homeowners who haven’t filed a claim over a three- to five-year window. Take care of small, non-emergency repairs yourself if possible, as filing minor claims could result in higher premiums later. Keeping your claims record clean signals to insurers that you’re a low-risk customer, which can translate to long-term savings.

Review and Update Your Policy

Insurance needs change as your home, family, and financial situation evolve. Regularly reviewing your policy—at least once a year—ensures your coverage fits your current circumstances and that you’re not over- or under-insured. Consider your home improvements, new purchases, updated property values, and any lifestyle changes that might impact your needs. Doing an annual policy comparison among different insurers can also uncover better rates and terms, particularly as new products and discounts enter the market. More tips on evaluating and tailoring coverage are available through Consumer Reports.

Inquire About Lesser-Known Discounts

Many homeowners miss out on policy discounts simply because they don’t ask. Insurers offer cost reductions for smart home devices, non-smoking households, retirees, long-term loyalty, and even for paperless policy statements. Sometimes, a simple call to your agent to review your current status and ask about potential qualifying factors can lead to surprising savings. Don’t forget to mention any recent renovations, upgrades, or lifestyle changes that could reduce your risk profile and boost your eligibility for new discounts.

Conclusion

Lowering your homeowners insurance premiums doesn’t require sacrificing coverage or security. Instead, focus on holistic safety improvements, strategic policy management, and proactive communication with your insurer. Whether you’re navigating high-risk markets or simply seeking everyday savings, a thoughtful approach can shield your finances while keeping your property well-protected. Small steps today—like inquiring about new discounts or planning for a higher deductible—add up to significant long-term benefits for your home and budget.