Generally speaking, a crypto DCA bot operates using dollar-cost averaging in an automated manner, without requiring the user to place repeating orders manually. It spreads orders across time or price dips to average out cost basis and diminish risk from volatility, and rather than building or exiting positions all at once, it does so in parts.

Core Mechanics Behind a DCA Crypto Bot

With a DCA bot crypto, you set a bunch of parameters, such as initial entry, budget, number of averaging or safety orders to place if the price moves against you, the spacing between these averaging orders (price steps), multipliers for the size of orders, and exit logic with take profit or stop loss, or trailing order. When the price moves down, more buying is performed by the bot to drag the entry average lower; upon rebounding enough to take profit, the bot closes the position or parts thereof, depending upon the configuration.

DCA Bot Crypto Advantages

It helps reduce timing risk just on the principle of letting in some volatility and averaging your entries among different transactions. Rather, it smooths out the cost basis and ensures against experiencing major remorse in the event of buying from above. It is also a great way to keep you from emotional trading because the bot works by a defined set of rules, not by whim. If well-framed, your exit logic can help harvest profits from rebounds in volatile markets.

The GoodCrypto DCA Bot Crypto Implementation

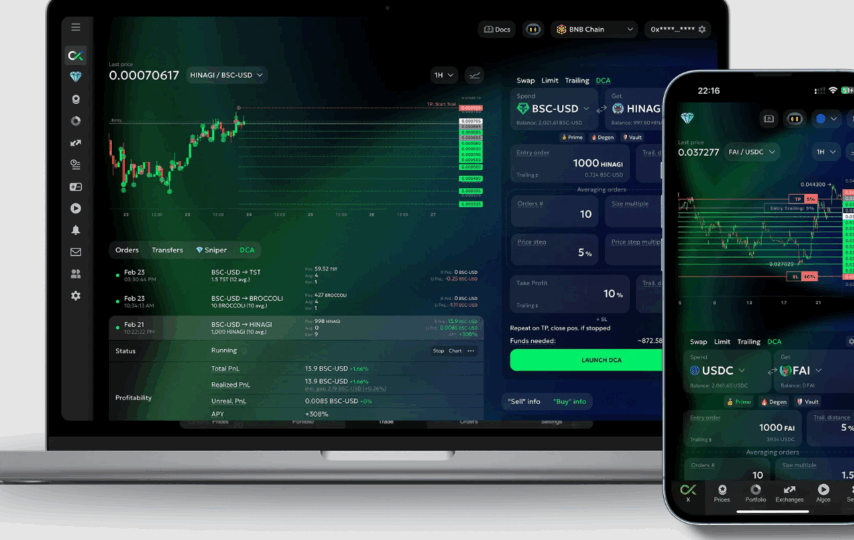

GoodCrypto offers a complete feature set for DCA bot crypto affairs for centralized and decentralized exchanges alike. Their DCA bot works by automatically placing additional orders when the market moves against your initial entry in order to improve your average cost. It lets you adjust ultimate take profits and stop losses depending on the average price. GoodCrypto supports Manual mode (full parameter control), Auto TA Signal mode (technical-analysis driven), and TradingView webhooks for triggering entries or exits.

Supported Strategies in GoodCrypto’s DCA Bot Crypto

Safety Net Strategy: started with an entry and safety orders below, so as to survive dips and get out with profits as the price retraces. Volatility Scalper Strategy: combining multiple take profit triggers, trailing exits, and auto-repeat-on-take-profit so that the bot keeps grabbing small profits as the price oscillates. “Buy-The-Dip” Strategy: accumulate assets over time by buying more as the price falls, so long-term accumulation benefits when the price goes back up.

Setting GoodCrypto’s DCA Bot Crypto Properly

Connect your exchange or wallet via API or directly from the non-custodial wallet for DEX trades. Define your initial order first: amount, entry type (market, limit, or perhaps trailing entry). Then choose the number of averaging orders, the size of each, and the multiplier-number-step. Price steps or intervals between averaging orders. Set exit logic: take profit percentage, stop loss from last averaging order, trail profit settings, or partial exit. If in Auto TA mode, select indicators or signal strength to trigger entry or reentry.

Real-World Case Studies Using GoodCrypto DCA Bot Crypto

One of the case studies deals with a DCA bot for JUP/USDT that ran for a period of six months via GoodCrypto, having a rough ROI of about 193% while placing multiple averaging orders from auto-TA signal generation and employing leverage in the futures markets, but managed risk with adequately placed stop-loss and take-profit settings; the other made above 200% returns in a Bitcoin futures trade with a DCA bot starting small and using safety net measures to absorb volatility before profit was realized.

Risk and Things to Be Mindful of When Using DCA Bot Crypto

A very well-designed DCA bot crypto strategy may suffer, given moves that are too sharp with safety nets running down. Improperly calculated stop-loss distances or price step spacing can usher in losses worth thousands or outright total losses before prices begin to rebound. Heavy fees or slippage for a trade on a DEX or a chain can compromise returns. Unexpected contract risk and liquidity depletion for new token projects can cause averaging orders to be filled poorly, or in some cases, not at all. Use of excessive leverage also increases danger: margin and futures amplify both reward and the danger of liquidation.

Best Practices to Maximize Performance of DCA Bot Crypto

Starting with a small capital should be a test of the settings, particularly for volatile or illiquid tokens. Use a reasonable number of safety orders with suitable price step intervals to avoid diluting your capital too thinly. Keep exit logic tight but realistic: a take profit should incorporate the rebound expected, while from a stop loss, it should lessen the risk. Change your strategy settings once market volatility increases or trends start to change. Use an alert system to keep track of bot activities in order to intervene at the right time, if needed.

How GoodCrypto Improves Your DCA Bot Crypto

GoodCrypto has a strong UI with visual guides to configure the bot, set on-chart entries and exits, track performance metrics, and calculate profit and loss from averaging orders. Its support across numerous exchanges and both centralized and decentralized trading allows flexible deployment of the bot wherever fee, liquidity, or token-related constraints might favor a particular option. Security-wise, API keys are encrypted, non-custodial wallet options are offered for Dex, and risk filters are put to good use. You get a 14-day free trial with GoodCrypto to test out the DCA bot crypto tool before committing.

Correctly positioned where DCA Bot Crypto fits into the broader strategy.

Working DCA bot crypto works well within a diversified approach: for accumulation of long-term assets, to smooth out cost basis, or to work alongside other bots like grid, trailing stop, or sniper. Use it for positions that you think can rebound in the long term instead of expecting fast, huge gains. Never put all your capital in DCA bot crypto trading because you should keep some for stable assets or more predictable investments.

Conclusion: Is DCA Bot Crypto the Tool You Need?

Entering DCA bot crypto is an excellent way for the speculator to navigate the volatile market, preserving capital and decreasing the feeling of regret that might arise due to improper timing of entry into the market. Making the bot easily accessible and configurable, GoodCrypto also keeps it highly secure and flexible. By automatic averaging, it supports dynamic exit logic and multiple modes across different exchanges and chains—all cleverly giving the user tools to build or accumulate with discipline. If you plan carefully, monitor the performance, understand the risks involved, and choose good settings, then DCA bot crypto may become a reliable part of your crypto toolkit instead of a gamble.